TRUSTEES' REPORT AND ACCOUNTS 2024 61

Unrestricted

funds

£'000

Restricted

funds

£'000

Endowment

funds

£'000

Total

2024

£'000

Total

2023

£'000

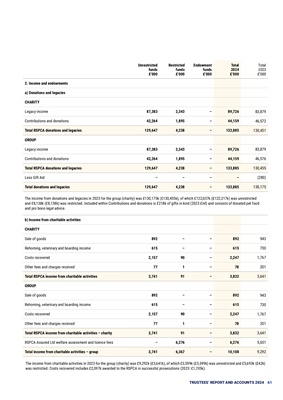

2. Income and endowments

a) Donations and legacies

CHARITY

Legacy income 87,383 2,343 - 89,726 83,879

Contributions and donations 42,264 1,895 - 44,159 46,572

Total RSPCA donations and legacies 129,647 4,238 - 133,885 130,451

GROUP

Legacy income 87,383 2,343 - 89,726 83,879

Contributions and donations 42,264 1,895 - 44,159 46,576

Total RSPCA donations and legacies 129,647 4,238 - 133,885 130,455

Less Gift Aid - - - - (280)

Total donations and legacies 129,647 4,238 - 133,885 130,175

The income from donations and legacies in 2023 for the group (charity) was £130,175k (£130,455k), of which £122,037k (£122,317k) was unrestricted

and £8,138k (£8,138k) was restricted. Included within Contributions and donations is £218k of gifts in kind (2023 £nil) and consists of donated pet food

and pro bono legal advice.

b) Income from charitable activities

CHARITY

Sale of goods 892 - - 892 943

Rehoming, veterinary and boarding income 615 - - 615 730

Costs recovered 2,157 90 - 2,247 1,767

Other fees and charges received 77 1 - 78 201

Total RSPCA income from charitable activities 3,741 91 - 3,832 3,641

GROUP

Sale of goods 892 - - 892 943

Rehoming, veterinary and boarding income 615 - - 615 730

Costs recovered 2,157 90 - 2,247 1,767

Other fees and charges received 77 1 - 78 201

Total RSPCA income from charitable activities - charity 3,741 91 - 3,832 3,641

RSPCA Assured Ltd welfare assessment and licence fees - 6,276 - 6,276 5,651

Total income from charitable activities - group 3,741 6,367 - 10,108 9,292

The income from charitable activities in 2023 for the group (charity) was £9,292k (£3,641k), of which £3,599k (£3,599k) was unrestricted and £5,693k (£42k)

was restricted. Costs recovered includes £2,097k awarded to the RSPCA in successful prosecutions (2023: £1,705k).