TRUSTEES' REPORT AND ACCOUNTS 2024

80

Notes to the accounts continued

YEAR ENDED 31 DECEMBER 2024

Group

2024

£'000

Group

2023

£'000

Charity

2024

£'000

Charity

2023

£'000

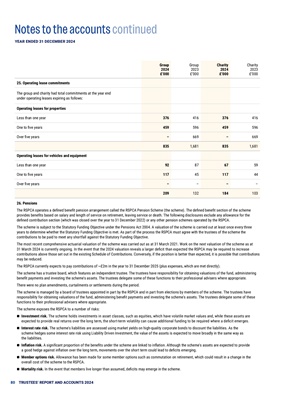

25. Operating lease commitments

The group and charity had total commitments at the year end

under operating leases expiring as follows:

Operating leases for properties

Less than one year 376 416 376 416

One to five years 459 596 459 596

Over five years - 669 - 669

835 1,681 835 1,681

Operating leases for vehicles and equipment

Less than one year 92 87 67 59

One to five years 117 45 117 44

Over five years - - - -

209 132 184 103

26. Pensions

The RSPCA operates a defined benefit pension arrangement called the RSPCA Pension Scheme (the scheme). The defined benefit section of the scheme

provides benefits based on salary and length of service on retirement, leaving service or death. The following disclosures exclude any allowance for the

defined contribution section (which was closed over the year to 31 December 2022) or any other pension schemes operated by the RSPCA.

The scheme is subject to the Statutory Funding Objective under the Pensions Act 2004. A valuation of the scheme is carried out at least once every three

years to determine whether the Statutory Funding Objective is met. As part of the process the RSPCA must agree with the trustees of the scheme the

contributions to be paid to meet any shortfall against the Statutory Funding Objective.

The most recent comprehensive actuarial valuation of the scheme was carried out as at 31 March 2021. Work on the next valuation of the scheme as at

31 March 2024 is currently ongoing. In the event that the 2024 valuation reveals a larger deficit than expected the RSPCA may be required to increase

contributions above those set out in the existing Schedule of Contributions. Conversely, if the position is better than expected, it is possible that contributions

may be reduced.

The RSPCA currently expects to pay contributions of ~£2m in the year to 31 December 2025 (plus expenses, which are met directly).

The scheme has a trustee board, which features an independent trustee. The trustees have responsibility for obtaining valuations of the fund, administering

benefit payments and investing the scheme's assets. The trustees delegate some of these functions to their professional advisers where appropriate.

There were no plan amendments, curtailments or settlements during the period.

The scheme is managed by a board of trustees appointed in part by the RSPCA and in part from elections by members of the scheme. The trustees have

responsibility for obtaining valuations of the fund, administering benefit payments and investing the scheme's assets. The trustees delegate some of these

functions to their professional advisers where appropriate.

The scheme exposes the RSPCA to a number of risks:

• Investment risk. The scheme holds investments in asset classes, such as equities, which have volatile market values and, while these assets are

expected to provide real returns over the long term, the short-term volatility can cause additional funding to be required where a deficit emerges.

• Interest rate risk. The scheme's liabilities are assessed using market yields on high-quality corporate bonds to discount the liabilities. As the

scheme hedges some interest rate risk using Liability Driven Investment, the value of the assets is expected to move broadly in the same way as

the liabilities.

• Inflation risk. A significant proportion of the benefits under the scheme are linked to inflation. Although the scheme's assets are expected to provide

a good hedge against inflation over the long term, movements over the short term could lead to deficits emerging.

• Member options risk. Allowance has been made for some member options such as commutation on retirement, which could result in a change in the

overall cost of the scheme to the RSPCA.

• Mortality risk. In the event that members live longer than assumed, deficits may emerge in the scheme.