TRUSTEES' REPORT AND ACCOUNTS 2024 71

Group

2024

£'000

Group

2023

£'000

Charity

2024

£'000

Charity

2023

£'000

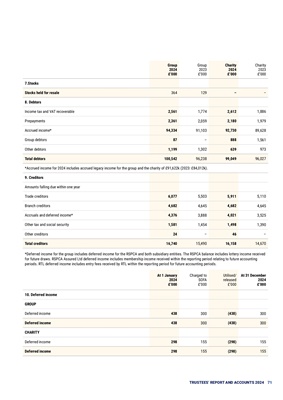

7.Stocks

Stocks held for resale 364 129 - -

8. Debtors

Income tax and VAT recoverable 2,561 1,774 2,612 1,886

Prepayments 2,361 2,059 2,180 1,979

Accrued income* 94,334 91,103 92,730 89,628

Group debtors 87 - 888 1,561

Other debtors 1,199 1,302 639 973

Total debtors 100,542 96,238 99,049 96,027

*Accrued income for 2024 includes accrued legacy income for the group and the charity of £91,622k (2023: £84,012k).

9. Creditors

Amounts falling due within one year

Trade creditors 6,077 5,503 5,911 5,110

Branch creditors 4,682 4,645 4,682 4,645

Accruals and deferred income* 4,376 3,888 4,021 3,525

Other tax and social security 1,581 1,454 1,498 1,390

Other creditors 24 - 46 -

Total creditors 16,740 15,490 16,158 14,670

*Deferred income for the group includes deferred income for the RSPCA and both subsidiary entities. The RSPCA balance includes lottery income received

for future draws. RSPCA Assured Ltd deferred income includes membership income received within the reporting period relating to future accounting

periods. RTL deferred income includes entry fees received by RTL within the reporting period for future accounting periods.

At 1 January

2024

£'000

Charged to

SOFA

£'000

Utilised/

released

£'000

At 31 December

2024

£'000

10. Deferred income

GROUP

Deferred income 438 300 (438) 300

Deferred income 438 300 (438) 300

CHARITY

Deferred income 298 155 (298) 155

Deferred income 298 155 (298) 155