TRUSTEES' REPORT AND ACCOUNTS 2024

72

Notes to the accounts continued

YEAR ENDED 31 DECEMBER 2024

Group

2024

£'000

Group

2023

£'000

Charity

2024

£'000

Charity

2023

£'000

11. Long-term creditors

Amounts falling due greater than one year

RTL marketing loan 805 - - -

Long-term creditors 805 - - -

The marketing loan includes all expenditure made up to the reporting date by RTL's chosen pet insurance provider on behalf of RTL. The expenditure pertains

predominantly to investment in promotional activities to generate increased commission income for RTL in future years. Under the terms of the agreement,

the loan will be repaid from September 2026 onwards through deductions to the commission payable to RTL for insurance sales made by RTL's chosen

pet insurance provider. Please refer to Note 1 for the measurement basis used in line with FRS 102. The loan has not resulted in any transfer of cash

to RTL and no interest is due. The final repayment date of the loan will be 31 August 2030.

At 1 January

2024

£'000

Charged to

SOFA

£'000

Utilised/

released

£'000

At 31 December

2024

£'000

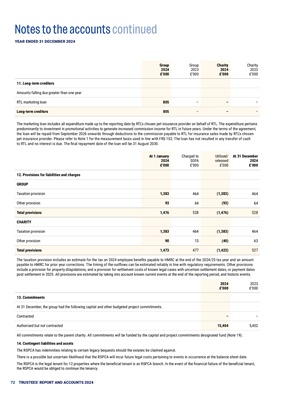

12. Provisions for liabilities and charges

GROUP

Taxation provision 1,383 464 (1,383) 464

Other provision 93 64 (93) 64

Total provisions 1,476 528 (1,476) 528

CHARITY

Taxation provision 1,383 464 (1,383) 464

Other provision 90 13 (40) 63

Total provisions 1,473 477 (1,423) 527

The taxation provision includes an estimate for the tax on 2024 employee benefits payable to HMRC at the end of the 2024/25 tax year and an amount

payable to HMRC for prior year corrections. The timing of the outflows can be estimated reliably in line with regulatory requirements. Other provisions

include a provision for property dilapidations, and a provision for settlement costs of known legal cases with uncertain settlement dates, or payment dates

post settlement in 2025. All provisions are estimated by taking into account known current events at the end of the reporting period, and historic events.

2024

£'000

2023

£'000

13. Commitments

At 31 December, the group had the following capital and other budgeted project commitments.

Contracted - -

Authorised but not contracted 15,404 5,402

All commitments relate to the parent charity. All commitments will be funded by the capital and project commitments designated fund (Note 19).

14. Contingent liabilities and assets

The RSPCA has indemnities relating to certain legacy bequests should the estates be claimed against.

There is a possible but uncertain likelihood that the RSPCA will incur future legal costs pertaining to events in occurrence at the balance sheet date.

The RSPCA is the legal tenant for 12 properties where the beneficial tenant is an RSPCA branch. In the event of the financial failure of the beneficial tenant,

the RSPCA would be obliged to continue the tenancy.