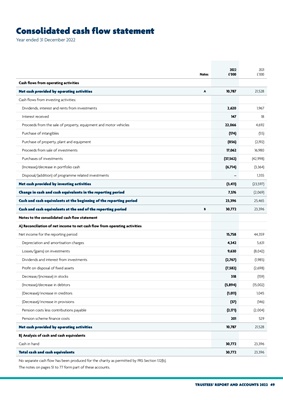

TRUSTEES' REPORT AND ACCOUNTS 2022 49

Notes

2022

£'000

2021

£'000

Cash flows from operating activities

Net cash provided by operating activities A 10,787 21,528

Cash flows from investing activities:

Dividends, interest and rents from investments 2,620 1,967

Interest received 147 18

Proceeds from the sale of property, equipment and motor vehicles 22,066 4,692

Purchase of intangibles (174) (55)

Purchase of property, plant and equipment (856) (2,192)

Proceeds from sale of investments 17,062 16,980

Purchases of investments (37,562) (42,998)

(Increase)/decrease in portfolio cash (6,714) (3,364)

Disposal/(addition) of programme related investments - 1,355

Net cash provided by investing activities (3,411) (23,597)

Change in cash and cash equivalents in the reporting period 7,376 (2,069)

Cash and cash equivalents at the beginning of the reporting period 23,396 25,465

Cash and cash equivalents at the end of the reporting period B 30,772 23,396

Notes to the consolidated cash flow statement

A) Reconciliation of net income to net cash flow from operating activities

Net income for the reporting period 15,758 44,359

Depreciation and amortisation charges 4,342 5,631

Losses/(gains) on investments 9,630 (8,042)

Dividends and interest from investments (2,767) (1,985)

Profit on disposal of fixed assets (7,582) (2,698)

Decrease/(increase) in stocks 318 (159)

(Increase)/decrease in debtors (5,894) (15,002)

(Decrease)/increase in creditors (1,011) 1,045

(Decrease)/increase in provisions (37) (146)

Pension costs less contributions payable (2,171) (2,004)

Pension scheme finance costs 201 529

Net cash provided by operating activities 10,787 21,528

B) Analysis of cash and cash equivalents

Cash in hand 30,772 23,396

Total cash and cash equivalents 30,772 23,396

No separate cash flow has been produced for the charity as permitted by FRS Section 1.12(b).

The notes on pages 51 to 77 form part of these accounts.

Consolidated cash flow statement

Year ended 31 December 2022