TRUSTEES' REPORT AND ACCOUNTS 2022 75

Notes to the accounts continued

Year ended 31 December 2022

24. Events after the end of the reporting period

Between the balance sheet date and the date the financial statements were approved by the RSPCA Board of Trustees, the RSPCA entered into a 10-year

commitment for the rental of new headquarter premises. The expected commitment value for the 10 years is £1.6m.

25. Pensions

The RSPCA operates a defined benefit pension arrangement called the RSPCA Pension Scheme (the Scheme). The defined benefit section of the Scheme

provides benefits based on salary and length of service on retirement, leaving service or death. The following disclosures exclude any allowance for the

defined contribution section (which was closed over the year to 31 December 2022) or any other pension schemes operated by the RSPCA.

The Scheme is subject to the Statutory Funding Objective under the Pensions Act 2004. A valuation of the Scheme is carried out at least once every

three years to determine whether the Statutory Funding Objective is met. As part of the process the RSPCA must agree with the trustees of the Scheme

the contributions to be paid to meet any shortfall against the Statutory Funding Objective.

The most recent comprehensive actuarial valuation of the Scheme was carried out as at 31 March 2021 and the next valuation of the Scheme is due as at

31 March 2024. In the event that the valuation reveals a larger deficit than expected the RSPCA may be required to increase contributions above those set

out in the existing Schedule of Contributions. Conversely, if the position is better than expected, it's possible that contributions may be reduced.

The contributions were recently reviewed as part of the 2021 actuarial valuation. The RSPCA expects to pay contributions of around £2m in the year to

31 December 2023 (plus expenses which are met directly).

The Scheme has a trustee board which features an independent trustee. The trustees have responsibility for obtaining valuations of the fund, administering

benefit payments and investing the Scheme's assets. The trustees delegate some of these functions to their professional advisers where appropriate.

There were no plan amendments, curtailments or settlements during the period.

The weighted average duration of the defined benefit obligation is around 15 years.

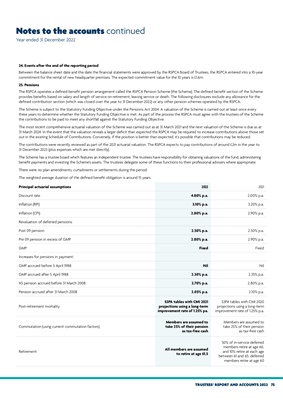

Principal actuarial assumptions 2022 2021

Discount rate 4.80% p.a. 2.00% p.a.

Inflation (RPI) 3.10% p.a. 3.20% p.a.

Inflation (CPI) 2.80% p.a. 2.90% p.a.

Revaluation of deferred pensions:

Post 09 pension 2.50% p.a. 2.50% p.a.

Pre 09 pension in excess of GMP 2.80% p.a. 2.90% p.a.

GMP Fixed Fixed

Increases for pensions in payment:

GMP accrued before 5 April 1988 Nil Nil

GMP accrued after 5 April 1988 2.30% p.a. 2.35% p.a.

XS pension accrued before 31 March 2008 2.70% p.a. 2.80% p.a.

Pension accrued after 31 March 2008 2.05% p.a. 2.10% p.a.

Post-retirement mortality

S3PA tables with CMI 2021

projections using a long-term

improvement rate of 1.25% pa.

S3PA tables with CMI 2020

projections using a long-term

improvement rate of 1.25% p.a.

Commutation (using current commutation factors)

Members are assumed to

take 25% of their pension

as tax-free cash

Members are assumed to

take 25% of their pension

as tax-free cash

Retirement

All members are assumed

to retire at age 61.5

50% of in-service deferred

members retire at age 60,

and 10% retire at each age

between 61 and 65; deferred

members retire at age 60