TRUSTEES' REPORT AND ACCOUNTS 2022 59

Total

2022

£'000

Total

2021

£'000

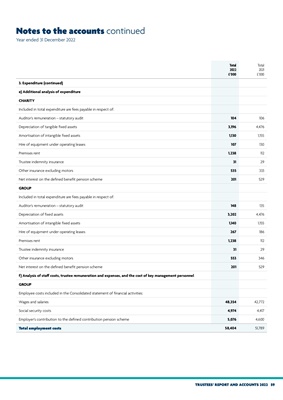

3. Expenditure (continued)

e) Additional analysis of expenditure

CHARITY

Included in total expenditure are fees payable in respect of:

Auditor's remuneration - statutory audit 104 106

Depreciation of tangible fixed assets 3,196 4,476

Amortisation of intangible fixed assets 1,130 1,155

Hire of equipment under operating leases 107 130

Premises rent 1,238 112

Trustee indemnity insurance 31 29

Other insurance excluding motors 535 333

Net interest on the defined benefit pension scheme 201 529

GROUP

Included in total expenditure are fees payable in respect of:

Auditor's remuneration - statutory audit 148 135

Depreciation of fixed assets 3,202 4,476

Amortisation of intangible fixed assets 1,140 1,155

Hire of equipment under operating leases 267 186

Premises rent 1,238 112

Trustee indemnity insurance 31 29

Other insurance excluding motors 553 346

Net interest on the defined benefit pension scheme 201 529

f) Analysis of staff costs, trustee remuneration and expenses, and the cost of key management personnel

GROUP

Employee costs included in the Consolidated statement of financial activities:

Wages and salaries 48,354 42,772

Social security costs 4,974 4,417

Employer's contribution to the defined contribution pension scheme 5,076 4,600

Total employment costs 58,404 51,789

Notes to the accounts continued

Year ended 31 December 2022